Labels

- Aishwarya Rai Bachchan

- Bhabhi

- Bollywood

- Economies

- Gujarat

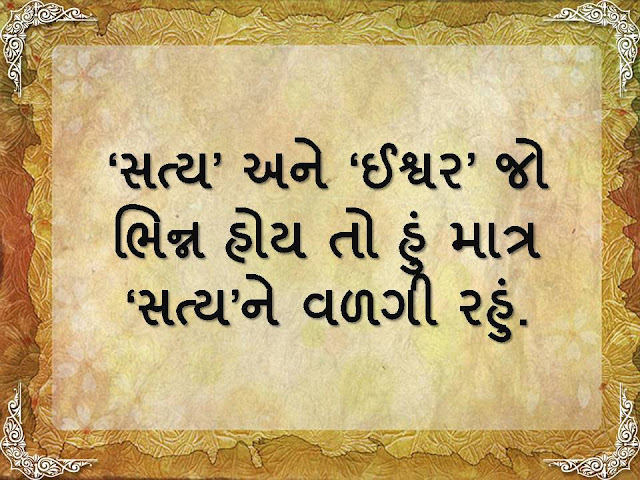

- Gujarati Quotes

- Gujarati suvichar

- Industries

- INFRASTRUCTURE DEVELOPMENT

- Kajal Oza Vaidya

- Kareena Kapoor Khan

- Malaika Arora Khan

- Nanad

- SEZ

- Shweta Nanda

- Soha Ali Khan

- Suvichar

- Uncategorized

- Viral

- અજબ ગજબ

- ગુજરાતી સુવાકયો

- ગુજરાતી સુવિચાર

- ટેક્નોલોજી

- ધાર્મિક

- ન્યુઝ

- બોલીવુડ

- રાશિ ભવિષ્ય

- રેસિપી

- લાઇફસ્ટાઇલ

- વાંચવા જેવું

- સુવિચાર

- હેલ્થ

Technology

Breaking News

[random][newsticker]

2016

Aishwarya Rai Bachchan

Bhabhi

Bollywood

Economies

Gujarat

Gujarati Quotes

Gujarati suvichar

Industries

INFRASTRUCTURE DEVELOPMENT

Kajal Oza Vaidya

Kareena Kapoor Khan

Malaika Arora Khan

Nanad

SEZ

Shweta Nanda

Soha Ali Khan

Suvichar

Uncategorized

Viral

અજબ ગજબ

ગુજરાતી સુવાકયો

ગુજરાતી સુવિચાર

ટેક્નોલોજી

ધાર્મિક

ન્યુઝ

બોલીવુડ

રાશિ ભવિષ્ય

રેસિપી

લાઇફસ્ટાઇલ

વાંચવા જેવું

સુવિચાર

હેલ્થ

INFRASTRUCTURE DEVELOPMENT

Sound physical

infrastructure with easy availability of key utilities is a dream scenario for

any investor. The state is aware of the fact that at present, the investment in

industry overshoots the investment in infrastructure. While this may offer

faster economic growth in the short run, it might ultimately prove to be

unsustainable.

Therefore, both industry and infrastructure should keep pace

with each other so that the balance of

regional development is not affected. Although Gujarat boasts of a State with

one of the best infrastructure facilities, it is realized that since last a few

years, other states in India have also

speeded up the activity to augment their infrastructure facilities. The state

has therefore, decided to benchmark itself with the quality of infrastructure

available in developed countries and would also ensure that this infrastructure

would be made available to both the industries and citizens at reasonable

tariffs. Thus, to hasten the pace of infrastructure development, the Government

would consider revisiting the existing Vision 2010 document and tailor

the infrastructure projects by adding lucrative features, so as to attract

private sector investment, more specifically the global players. In addition, projects with smaller

financial magnitude may be identified and implemented with the help of private

sector investment immediately. The state would also commission a study

to identify the deterrents if any, coming in the way of private sector

investment in infrastructure projects and remove them immediately.

Development of infrastructure is the top priority on the state agenda.

Information: The Key to Success for any business enterprise

This

is the era of information and awareness. The person who has maximum information

on the subject he deals with will ultimately win amongst all his competitors.

This dictum is true in the case of establishing and managing any business

enterprise. The Government realizes this fact and has thus decided to equip the

new entrepreneurs as well as the existing enterprises with the latest

information available in the relevant fields. A new entrepreneur would require

information right from the stage of selection of a project, market potential,

availability of infrastructure at different alternative locations, Government

assistance and facilitation, economic and social indicators, regulatory

framework governing a particular industry/activity, compliance of laws, pollution

norms, procedural aspects, etc.

At the

state level, iNDEXTb has been functioning to act a single point contact for all

the information needs of an entrepreneur since last over 25 years. The services

of iNDEXTb have been very widely acknowledged by the industrial community not

only in India but also in many parts of the world. The Government now plans to

make available all the relevant information at the district level by installing

information kiosks at important places. In addition, capacity building of the

counseling staff is also envisaged by imparting training. For the purpose, the

Government of Gujarat would like to make extensive use of information

technology at all the levels.

Special Economic Zones : Paradise for Investors

The Government of Gujarat

has recently promulgated ordinances to facilitate setting up of Special

Economic Zones and Industrial Parks. As per the provision of this ordinance,

the responsibilities of management of the Zone and all the permissions under

Single Window to the industrial units coming up in the Zones are vested with

the Development Commissioner of Government of India. In addition, all the powers, duties and

responsibilities for compliance of provisions under various labour laws as

available with Labour Commissioner, have also been delegated to the Development

Commissioner. In order to attract entrepreneurs for investing in the Zones, the

Government has also decided to offer certain incentives. The industrial units

setting up a power plant for his captive requirements would be offered

electricity duty exemption for a period of 10 years.

The units coming up in the

Zone are also exempt from the levy of stamp duty or registration fees on

transfer of land, loan agreement, credit deeds, mortgage documents or any other

contracts. Sales tax, purchase tax, motor spirit tax, luxury tax, entertainment

tax and other taxes are also exempted for the units set up in the Zone. The

Government has also exempted the tax on the supply of raw materials from the

domestic tariff area to the units located in the Zone. In Gujarat, at present,

Special Economic Zones at Kandla and Surat are already in place. The State

Government also plans to set up such SEZs at locations like Dahej, Hazira and

Mundra in the near future, of which permissions for SEZs at Dahej and Mundra

from Government of India have already been received. The facilities being

developed in the Special Economic Zones in Gujarat are going to prove to be

paradise for the investors in the times ahead and as a result, a sizeable

investment is expected to be materialized. At present, this ordinance has been

sent for Presidential accent through Central Government which is expected to be

received soon.

Industries in Gujarat

Gujarat has been the

front-runner in the overall economic development of the country all these

years, as is evident from the fact that with mere 6% of geographical area and

5% of the population of India, the state contributes to 21% of the country’s

exports and 6.42% of the national GDP at constant prices. If the decadal growth

of performance of some of the Indian states vis-à-vis other Asian economies

with that of Gujarat is compared, one gets quite an encouraging scenario. The

industrial growth of Gujarat with a figure of 8.52% could be way ahead of many

Indian states and other Asian Tigers viz. Singapore, Malaysia and Korea.

Flexibility of Labour Laws: A unique feature of Gujarat

Gujarat is one of a very

few states, which has embarked upon the path of labour reforms. The

‘flexibility’ aspect of labour reforms of Gujarat might strengthen its position

as an ideal destination for investment besides other factors, in the coming

years. In addition, initiatives like Self-Certification and Single Business Act

would leave an indelible mark as one of the best in the contemporary

environment. The Government however reiterates its faith in the statement that

– Development should not be at the cost of Environment. At the same time, it

should not be used as an alibi for stalling the developmental pace. An honest

attempt would also be made to organize the agriculture commodities business by inculcating

the element of professionalism and by extensive use of modern technology in the

processing.

Subscribe to:

Comments (Atom)

Author Name

Powered by Blogger.